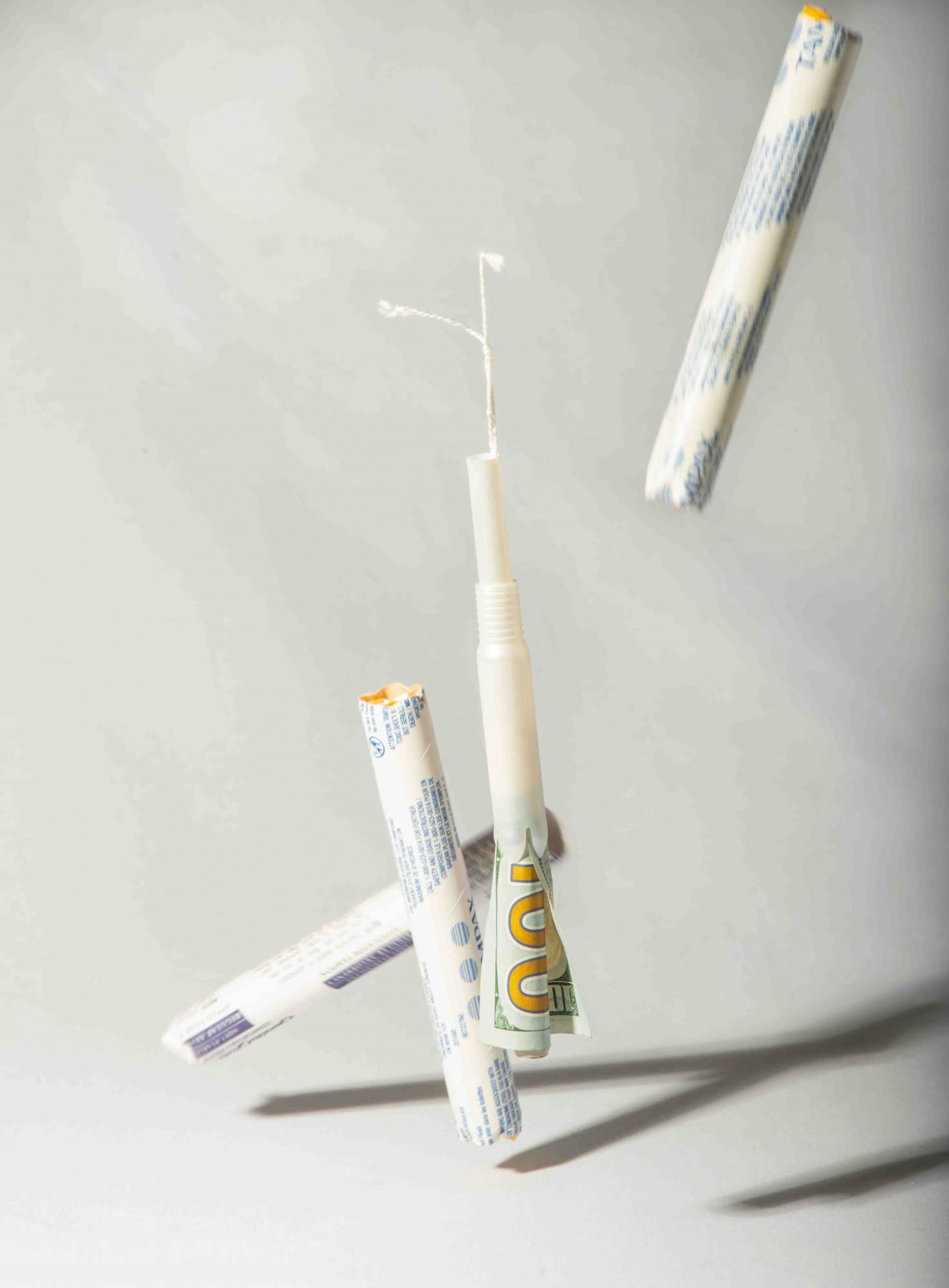

The Michigan state House of Representatives passed two bills that would end the state’s 6% sales tax on menstrual hygiene products, a step towards ending the “Tampon Tax” that menstruators in the state have long been dealing with.

House Bills 4270 and 5267 were passed on Oct. 14 with overwhelming bipartisan support. The two measures would amend Michigan’s tax code to ensure that menstrual hygiene products, including “tampons, panty liners, menstrual cups, sanitary napkins, and other similar tangible personal property” related to menstruation would be legally considered necessities, along with previously included items such as bandages and condoms.

Michigan legislators spoke of the bills often using the words “essential” and “common sense.”

“I think it's important for people who menstruate and their families, and that’s just about everybody, to get this little bit of tax relief,” Rep. Kara Hope, D-Mason, said. “Menstrual products are a necessity, they're not a luxury.”

Rep. Laurie Pohutsky, D-Livonia, said, “I think that it is an important first step in ending period poverty. This is something that the Democratic caucus has been working on for quite some time, so I'm glad to see it finally pass through the House, and I'm hopeful about it making its way through the Senate as well.”

The measures were part of a two-bill package that had to be passed as such due to Michigan laws limiting the scope of any one bill. Rep. Bryan Posthumus, R-Kent County, sponsored the second half of the measure and discussed the law’s financial impact.

“I think this is a big win for families and individuals throughout the state of Michigan,” Posthumus said. “We're putting roughly $7 million back in the pockets of taxpayers throughout the state. I don't know that we've passed any tax cuts for individuals since the governor took office back in January 2019, and this is a good opportunity to do just that.”

The House Fiscal Agency said in a report on the bills that current annual sales tax on such menstrual hygiene products amount to the referenced $7 million figure.

“I don't look at it much as a gender issue, I look at it as helping families and individuals throughout the state,” Posthumus continued. “It shows that the time has come to give tax relief to families and individuals throughout the state.”

Rep. Sarah Anthony, D-Lansing, pointed out the measure’s capacity to further equity in the state.

“We know that these types of taxes disproportionately impact low-income women and women from marginalized communities,” she said. “This is just one example of us trying to make a more equitable and fair society by prioritizing issues that impact women. So, I am encouraged by and excited that we're taking a step in the right direction.”

Rep. Julie Brixie, D-East Lansing, said that she had a personal connection to this topic, recounting when her own children, then in middle school, learned about the taxing of menstrual products.

“Now that I'm in the legislature and in a position to do something about it, of course I want to advance this legislation because it's about equity, and it's about doing what's right, and recognizing that menstrual products are essential items,” she said.

Brixie credited Rep. Padma Kuppa, D-Troy; Rep. John DaMoose, R-Harbor Springs, and Rep. Mark Tisdel, R-Rochester Hills, with jump-starting this legislation.

Pohutsky and Brixie also discussed the far-reaching implications of these measures on things like school attendance and public health.

“We know that there are people who menstruate who have to miss school or miss work because they can't afford the period products that they need to be able to do that,” Pohutsky said.

Echoing this point, Brixie said, “If you think about young people in particular, you know, kids who are in high school, who are living in poverty, the ramifications of not having enough money to purchase appropriate period products can be really damaging and stigmatizing.”

“If you only have one pair of jeans and you stain them, you're not going to go to school, and so menstruation and lack of access to period products contributes to absenteeism in school, and that's something that is really unfortunate and sad.”

Both of these bills passed with significant bipartisan support, with a vote of 94-13 for each of them. Many representatives praised the legislature for being able to come together on this issue.

“We have been able to find common ground on some common sense measures, and I think this is one of those common sense measures — it just really makes sense,” Hope said. “It’s a matter of basic fairness.”

Support student media!

Please consider donating to The State News and help fund the future of journalism.

“The work of people in the last 10 years or so who have been talking about menstruation openly and making it not a taboo subject — I think we have them to thank really for the fact that this did pass so easily and handily.”

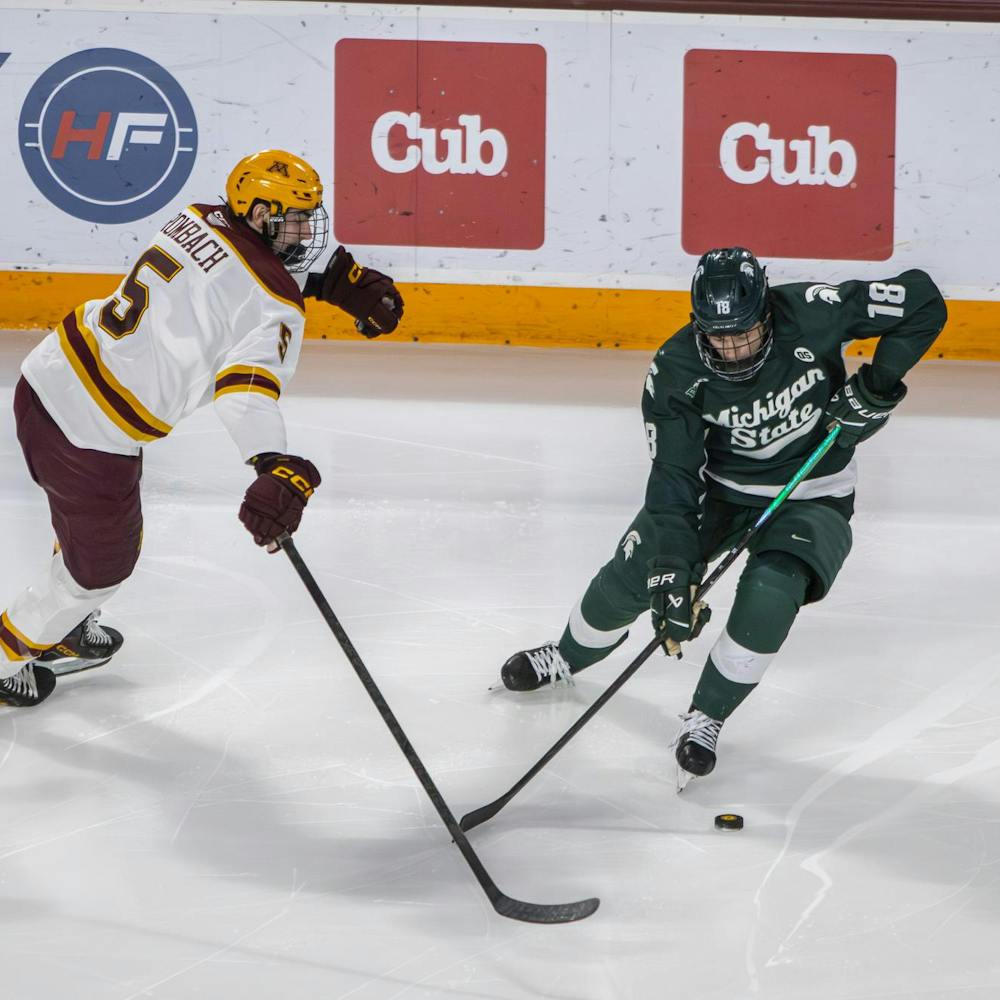

Brixie, who represents MSU’s main campus, said, “It's one of these laws that when you look at it you realize that we have laws on the books that exist from a time when only men served in the legislature, and that they weren't thinking primarily about women's issues, or people's issues besides themselves.”

Pohutsky added, “The fact that these passed with bipartisan support just shows me that it's good policy, it's policy that makes sense. This isn't a partisan issue, it's not a controversial issue.”

Discussion

Share and discuss “State representatives talk the passage of bills to repeal Tampon Tax” on social media.