It’s officially tax season, folks. From now until April 15, expect to see tax firms’ appointment books filled to the brim and a plethora of television commercials referring to taxes, tax returns and, most importantly, tax refunds.

There are many different services students can utilize to file their tax returns. There are online services, including TurboTax and FreeTaxUSA, as well as living and breathing tax experts at agencies such as H&R Block and Jackson Hewitt.

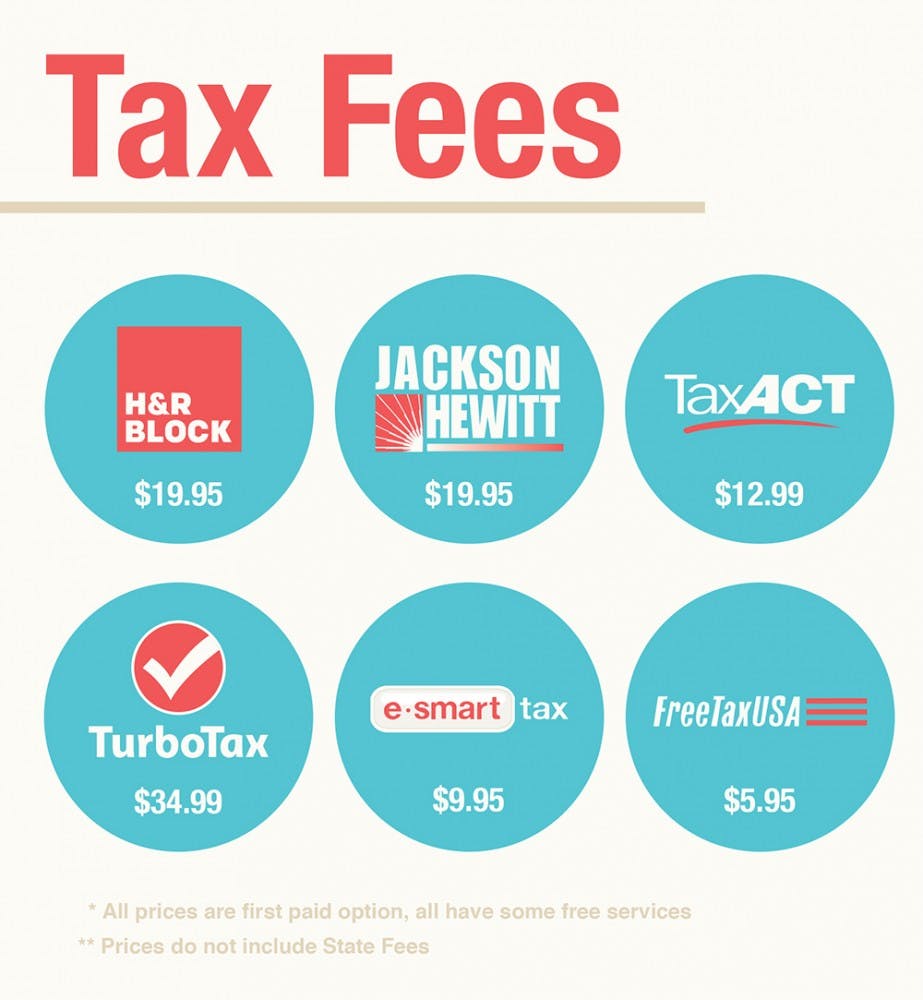

Each service charges different fees for their services and each package a firm offers comes with different fees as well. Also, on top of the fee that each tax service provider charges for federal tax returns, there is a separate fee for filing state tax returns.

It is necessary to file different tax returns for state and federal, accounting professor Edmund Outslay said.

“The federal government and the State of Michigan have separate tax systems that require separate returns,” Outslay said. “The State of Michigan income tax begins with the federal tax return and adjusts for certain items to create Michigan taxable income.”

TurboTax offers a free state tax return on their basic package, the only package in the industry which offers free state tax returns for those who qualify based on income. So when a firm says it can do taxes for free, be wary because the firm could only be referring to federal taxes. Last year, TurboTax charged $36.99 for each state tax return.

This year, H&R Block, the largest tax preparation firm in the country, offers four packages — basic, deluxe, premium and premium and business. With each different H&R Block package, different tax areas are covered and the coverage is improved with each package.

The basic package, for instance, is software that is best for “simple tax situations,” according to H&R Block’s website. With the basic package, a person gets free technical support on the phone or via online chat, and tax information from the past six years is stored for each customer. A customer also gets 5 percent extra bonus on their federal refund.

The deluxe package, best for “homeowners or investors,” includes each basic package feature, but also includes guidance on interest for a mortgage, help with investments and valuation of donations. The deluxe package also promises a 10 percent extra bonus on federal refunds.

TurboTax lists the deluxe package as their most popular package. The deluxe package will cost a taxpayer $34.99 for federal returns and $36.99 for state returns. All prices are subject to change.

As for which is the better option, it is entirely up to each person.

“TurboTax is very user-friendly and is cheaper depending on whether you buy the state income tax package, which is recommended,” Outslay said. “H&R Block will cost more. They might find more deductions or credits that you might have missed on your own, but TurboTax prompts you with questions that help you identify tax reductions and credits.”