The Michigan State University Board of Trustees will consider establishing a series of rigid tests for evaluating campus calls for changes to its investment portfolio based on ethical reasons.

The board will vote on establishing procedures for a presidentially appointed committee of students, staff and faculty to consider concerns over particular investments, one year after it first committed to establishing the body in response to activists’ calls for MSU to divest from Israel.

The criteria outlined in the committee charter represent a high bar that requests must clear before the committee can send its recommendations to the president, who can choose whether to refer those recommendations to the board.

Under the proposed rules, a request made to the committee must prove that there are "extraordinary circumstances" that warrant potentially altering MSU’s investment pools even if doing so could hurt the university financially. The committee would also only consider taking action that could have a tangible impact the issue at hand.

What exactly constitutes an extraordinary circumstance, or how the committee would determine that the university could impact said circumstances, is not specified in the charter. MSU spokespeople Amber McCann and Emily Guerrant did not respond to requests for clarification at time of publication.

A request would also need to be backed by "considerable, thoughtful and sustained campus interest" into the actions of an organization in the university’s investment portfolio, which the committee would be charged with determining. The committee would also only take up requests about issues where a "central (university) value" is at stake, such as its commitment to equity or to "the highest ethical" standards.

Finally, the committee would need to agree that it's possible for the campus community to reach a consensus on how the university should respond to the situation.

If the committee determines that a consensus is reachable, it would then be able to make recommendations to the president, who can then choose to share them with the board, the ultimate steward of the endowment.

Potential non-binding recommendations the committee could make include that MSU pull out of certain investments and that the university makes "its views on these issues known to the public" — though MSU must also balance any public statement with its position in exercising "institutional restraint."

If approved by the board, the formation of the committee would represent a win for university leaders who have championed a bureaucratic process as a more productive means for addressing concerns about its investment portfolio, as opposed to those concerns being aired during public comments at board meetings with little opportunity for dialogue.

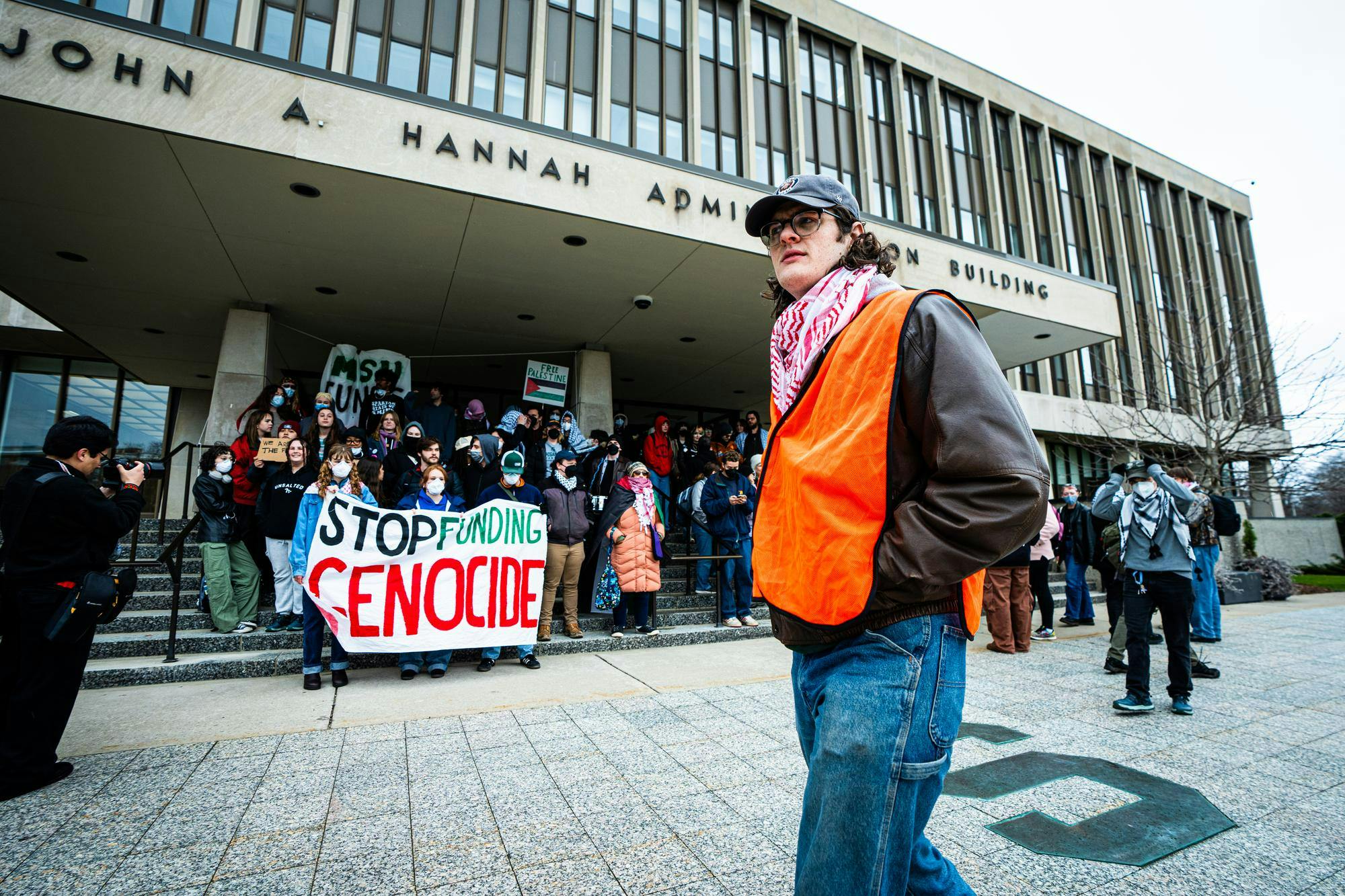

For student activists who have been pressuring MSU to divest from its investments in an Israeli bond and funds they tie to weapons manufacturers, the proposed criteria does little to change their negative posture toward the committee. They say that the committee is an attempt to appease students while making it harder for divestment advocates to get what they want, regardless of what criteria is being used to evaluate requests.

"All this committee does is add an extra layer of bureaucracy before you have to convince the president," social relations and policy senior David Hogan said. "So, the power lies completely in the hands of President Guskiewicz."

The charter also states that members of the committee would be required to recuse themselves from handling issues related to their activities outside the university. Hogan, who is also a member of the Hurriya Coalition, a collective of roughly 20 pro-divestment student groups, said that policy would make it impossible for students in favor of divestment from Israel to vouch for that action as a committee member, if Guskiewicz were to appoint any of them.

According to the charter, the twelve-person body will be made of three faculty members, three students, three university employees and three at-large members that could include administrators, alumni or community partners, all appointed by the president.

Faculty, staff and at-large members would serve for two 9-month terms, aligned with the academic calendar. Student members would serve for a single 9-month term.

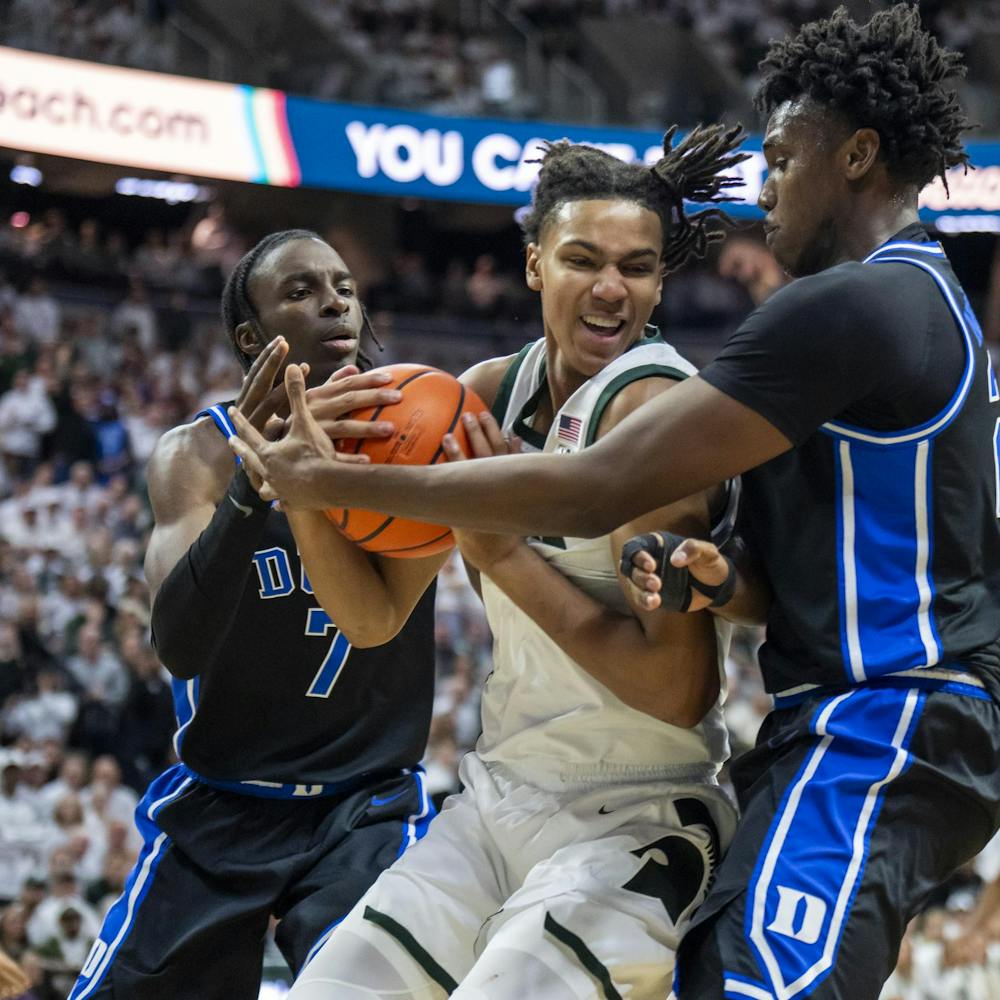

MSU’s establishment of a committee tasked with reviewing investment proposals for "non-financial reasons" and making non-binding recommendations based on those proposals follows suit of other universities, including Big Ten peer Northwestern, which resurrected its investment committee in February as part of a deal with student activists.

Other universities have had longstanding committees meant to handle the ethical implications of their investments. Columbia University, for example, has had its Advisory Committee on Socially Responsible Investing since 2000.