As he smoked a Chinese cigarette outside Wells Hall, Xiangyu Lin said he was not surprised to hear that an increasing percentage of cigarettes smoked in Michigan are bought out of state.

After all, he was holding one of them.

As the recession hit, more and more smokers bought cigarettes from out of state to dodge high tax rates.

—As he smoked a Chinese cigarette outside Wells Hall, Xiangyu Lin said he was not surprised to hear that an increasing percentage of cigarettes smoked in Michigan are bought out of state.

After all, he was holding one of them.

Lin, a mathematics and statistics senior, is one of many smokers who buy cigarettes from outside Michigan.

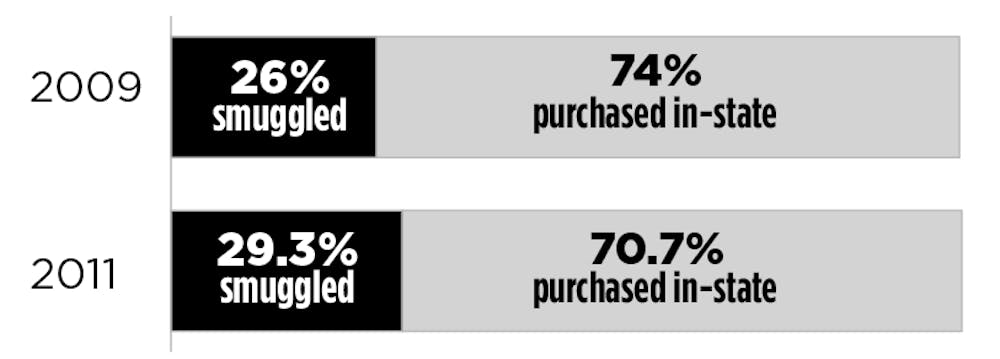

In 2011, almost 30 percent of the cigarettes smoked in Michigan were smuggled from other states, according to research from the Mackinac Center for Public Policy, which factored information from 47 of 48 states.

Michael LaFaive, director of Morey Fiscal Policy for the Mackinac Center for Public Policy, said the high smuggling rate is partly because Michigan currently has the 10th highest tax rate at $2 per pack, according to statistics from the Campaign for Tobacco-Free Kids.

The number of cigarettes from out of state represents about 3 percent increase from 2009, which LaFaive said can be attributed to Michigan’s recession.

LaFaive said there are two different types of cigarette smuggling in Michigan — casual and commercial.

Casual smuggling is when an individual travels to states with lower taxes to buy cigarettes, while commercial smuggling is bringing in large supplies of cigarettes. Most of the commercially smuggled cigarettes consumed in Michigan are from North Carolina and Virginia, two states with very low tax rates, LaFaive said.

LaFaive said many cigarette smugglers are caught when making a large purchase close to a border, which might be brought to the police’s attention from a tip. Also, police might conduct a search of a cigarette distributors’ merchandise looking for the invoice. If that information does not match the tax stamp, the retailer is busted.

“One cigarette is illegal, but the Michigan police are not going to get you for that — they have bigger fish to fry,” LaFaive said.

Donald Dawkins, special agent with the Department of Justice’s Bureau of Alcohol, Tobacco, Firearms and Explosives , said smuggling cigarettes causes a loss in revenue for the state. He said the penalties for smuggling cigarettes are handled differently depending on the severity of the crime and the state’s rules, but a federal crime could mean up to five years in jail.

“(It’s) a problem that is in ways difficult to get a handle on,” Dawkins said. “We go on case by case, (but) right now our main priority is violent crime.”

Lin, who has never smuggled cigarettes, said there is a two-carton limit for bringing cigarettes into the U.S. from China, but he said some people bring more because the security does not check every time.

“If you get caught you just have to pay a little more,” Lin said.

After Lin smokes all of his preferred Chinese cigarettes, he said it costs him about $5 to buy a pack from a local store, which is more than he would pay in China because of the currency difference.

Despite the increasing tax, students who want cigarettes still will buy them, Dawkins said. Whether they purchase them legally or smuggle them in from another state — or other countries — is another story.

“If people want cigarettes, no matter the tax, they are going to buy them — (that’s) true to every consumer,” Dawkins said.

Also read about programs in place to helps students and faculty quit smoking.

Support student media! Please consider donating to The State News and help fund the future of journalism.