Education junior Calvon Sheridan really hopes to make it big as a recording artist.

Sheridan, who is currently $25,000 in debt, said he knows that becoming wildly successful might be his only way out of the debt that is creeping up. A debt that’ll most likely only grow before he graduates.

“I hope I’ll blow up and make millions. And if not, I’ll be like every other teacher — struggling,” said Sheridan, who also added that his real passion is teaching.

Sheridan is just one of many students who are facing a massive student debt as a result of constant tuition hikes and other costs of attending college.

When MSU alumna Erica Shekell was applying for college, she knew paying for it was going to be difficult.

In 2013 Shekell graduated with two bachelor’s degrees in journalism and media arts and technology. She had $25,430 in student debt, she said.

Shekell said she was able to pay off her debt in less than two years, something not everyone can afford to do in such a short period of time.

“I have been able to pay for it because of my middle-class privilege and having the support of a few hundred family members, neighbors and scholarship donors,” Shekell wrote in an email. “I recognize that far too many of my friends are in debt up to their eyeballs.”

According to the Institute for College Access and Success, seven out of 10 students who graduated from a public institution will have to deal with student debt.

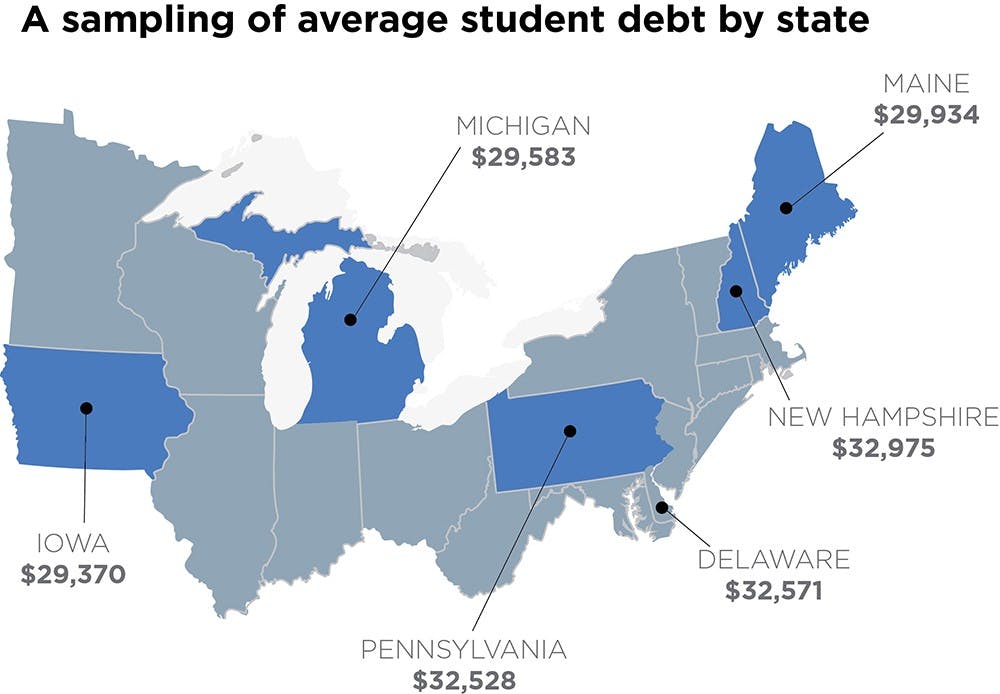

In 2013 the average per borrower was of $28,400 and, according to the Institute for College Access and Success, Michigan’s borrower average is higher — in Michigan, the average student debt is $29,583.

In the Michigan Senate House of Representatives, a couple of bills have been introduced that would grant tax credits to students who decide to stay in Michigan after graduating.

Under the bill introduced by state Sen. Curtis Hertel Jr., D-East Lansing, graduates who choose to stay in the state would be eligible to claim an income tax credit equal to the 50 percent of the amount paid on student loans during the tax year.

“The state needs to provide proper funding to higher education ... and we need to do something with students who have massive debt,” Hertel said.

"It's not worth it"

MSU alumnus Dan Birkholz graduated in May 2014 with a bachelor’s degree in interdisciplinary studies and $40,000 of debt.

Birkholz said when he was considering MSU there were not a lot of alternatives besides taking student loans.

“I didn’t even consider student debt,” Birkholz said. “It seemed normal to me, and I expected to be in a lot of debt when I graduated.”

Birkholz said he doesn’t like to think about his $40,000 of student debt. He uses this strategy to avoid stressing out.

“I called (the student loans company) and found a way to have my payments deferred until next January,” Birkholz said. “I’m not making any payments.”

Birkholz said it is not worth it to have a degree in exchange for thousands of dollars in student debt.

“I have friends who didn’t go to college, and they are making a lot of money right now,” Birkholz said. “They don’t have any student debt.”

Sheridan is similarly opposed to high tuition prices.

“We should not have to pay that much when (it) is necessary for us to have these degrees to even function in societies nowadays,” Sheridan said.

He said there has been a cultural shift in which a college degree is valued in places where it is not necessarily important to have one.

“If you even look at basic jobs, such as McDonald’s, they are requiring a high school diploma. But to be into management positions ... they are wanting you to have some type of hospitality and business degree or some type of finance degree,” Sheridan said.

English sophomore Parris Jones said having student debt can be overwhelming.

“It’s not guaranteed that we are going to get a job after graduating anyways, so we may have to settle for less,” Jones said. “Then we’ll struggle.”

Tuition hikes are hurting students

Across the United States, there has been a trend that follows the increase in tuition costs. MSU is not the exception.

According to the MSU Office of the Controller website, since 1979 the cost of attending MSU has increased significantly.

A credit hour in 1979 costed $24.50, which is equivalent to about $79 in 2015. This is a stark comparison to the cost of credit hours now — students paid $440 per credit hour last fall.

In order to be counted as a full-time student and to receive financial aid, a student must take 12 credits. That adds up to $5,280 in tuition costs per semester.

That’s not counting books, coursepacks, online access, fees or housing.

The case with tuition increase is an example of a positive feedback loop.

Val Meyer, the associate director of the MSU Office of Financial Aid, said when the state government decreases funding to higher education institutions, universities tend to increase the costs of tuitions to maintain an economic balance.

When Michigan Gov. Rick Snyder’s assumed office, his first budget recommendation called for deep cuts in higher education appropriations and MSU’s funding decreased 15 percent.

Each year afterward, higher education has received 1 to 2 percent increases, with the exception of last year. Still, funding has yet to return to levels before Snyder entered office.

“If the state doesn’t have as much money to give to higher education, how are they going to pay for the increase cost?” Meyer said.

Meyer said it all comes down to the MSU Board of Trustees to decide whether a tuition increase will be in place or not.

“In the long term, yes, tuition does tend to go up. And in the long term, we try to do other financial aid so that doesn’t go up as fast,” Meyer said.

In June 2014, during the most recent budget approval by the Board of Trustees, members voted to raise tuition between 2.6 and 3.6 percent.

In February MSU President Lou Anna K. Simon testified in front of the higher education joint committee comprised of state senators and representatives.

In the hearing Simon said the state has a “long-running disinvestment in its public universities.”

“MSU has worked hard to remain affordable, especially given the challenges we faced regarding state disinvestment over the last 50 years,” Simon said on Feb. 24.

Is there still hope?

MSU alumnus Kevin VanLiew graduated in 2014 with a bachelor’s degree in social relations and policy.

“I wanted to do public policy, and I was looking for a program and here it was pretty obvious it was going to be a good choice,” VanLiew said. “The opportunities I would get at Michigan State were better than staying in a state university in New York.”

VanLiew graduated with $20,000 in student debt, an amount he is still paying. He said he pays $155 monthly toward his student loans.

But there is still hope for college students.

Under Hertel’s bill, graduates who choose to stay in the state would be eligible to claim an income tax credit equal to the 50 percent of the amount paid on student loans during the tax year.

Hertel said retaining graduates in the state can be beneficial to the economy and to the workforce of the state.

Sheridan said he is not sure how it will all play out yet.

“We have to see how those bills play out because all the things seem good at first, especially when we have a thirst for change,” Sheridan said. “The only thing I’ve seen right now is an increase in my per credit rate, so until we see some changes, I can’t really say if these things are making a change or not.”

State Rep. Andy Schor, D-Lansing, reintroduced a version of the same bill in the Michigan House of Representatives on Wednesday as well.

“You can’t get a good job without a college degree,” communication junior Ryan Boudreaux said. “You can’t really live your life, you can’t really reach your full potential if you have to keep paying.”