If college education can be considered an investment, some researchers argue that students are getting far greater returns for their money than ever before.

The Hamilton Project, a Washington, D.C., research group, recently found that through the years, college tuition has provided an inflation-adjusted annual return of more than 15 percent, far outpacing the average annual return for real estate or stocks.

But, as the cost of attending classes climbs at MSU and schools around the country, some speculate the true value of a college education could be declining.

Paired with rising unemployment — which sat at 10.3 percent in the state of Michigan for the month of May, 1.2 percent above the national rate — some future graduates are concerned about the viability of their degree.

“I’m not really in a discipline that would make specifically an MSU degree valuable,” said Catharine Batsios, an English junior who said she’s been working toward her degree for the better part of the past decade. “Either I’m going to get a job or I’m not, based on what I can do.”

Some argue the benefits of obtaining a college education from an institution such as MSU remain clear.

“There have been studies that say that students with a degree are making more than students without a degree,” said Val Meyers, associate director of MSU’s Office of Financial Aid. “We obviously believe even if it doesn’t pay directly in money earned, that a degree is beneficial.”

The big picture

Concerns of college students in relation to the viability of higher education are echoed among adults across the country, recent studies show.

In a national telephone survey conducted by the Pew Research Center, 1,220 of 2,142 adults concluded the country’s higher education system doesn’t provide students with “good value” for the cost of that education, and more than 1,600 of those same respondents said college is becoming too costly for many average citizens to afford.

Batsios and other students agreed with those sentiments, saying the cost of attending MSU, combined with living in and around East Lansing, continually adds up.

“It’s expensive,” Batsios said.

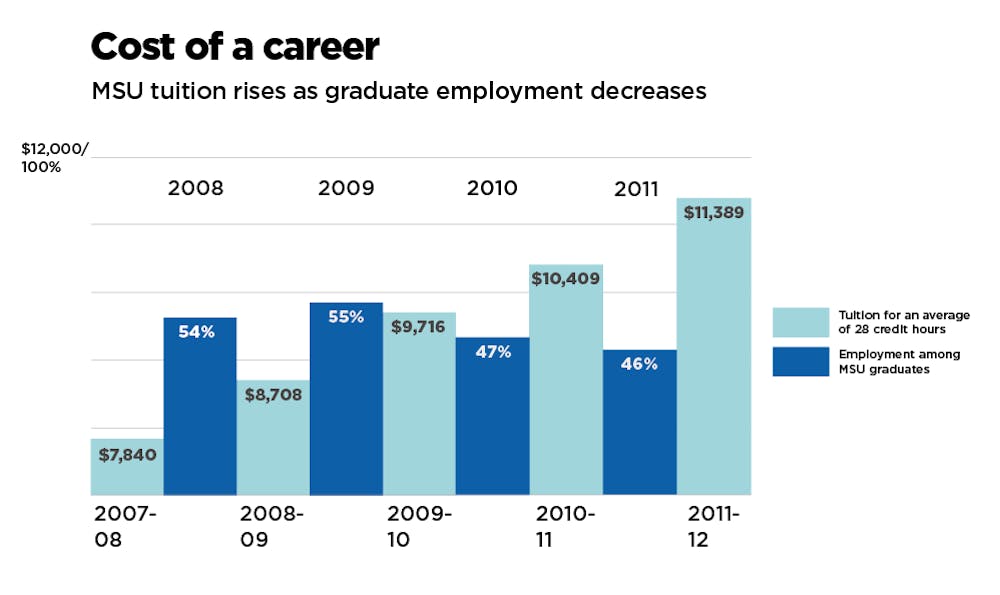

And that cost is rising. At MSU, tuition has spiked almost $4,000 since the 2007-08 academic year for an in-state undergraduate student taking 14 credits a semester. By comparison, the University of Michigan’s tuition has increased by about $2,187 over the same time period.

This year alone, tuition will jump almost $1,000 at MSU.

On the other hand, financial aid at MSU has climbed almost 300 percent since 2000, and will increase 10 percent this year. Those measures alleviate some burdens students face upon entering the job market, but statistics indicate a substantial amount still graduate with debt.

Almost 61 percent of in-state graduating seniors from the class of 2010 left MSU with Stafford loans from the Department of Education to pay back, some totaling more than $30,000.

“We don’t have a lot of students who borrow excessively, but we do have some,” Meyers said.

Compared to the Pew Center’s previous survey, about 48 percent of those respondents said paying off student debt made it more difficult to cover bills and other costs.

Special education junior Miranda Vanwynsberghe maintains debt is a natural part of attending college, no matter what the school.

That shouldn’t deter students from getting an education, she said.

“If you’re going to get in debt, a college degree is the best reason to,” she said.

Support student media!

Please consider donating to The State News and help fund the future of journalism.

Entering the job market

In addition to stresses surrounding student loans, many recent college graduates also must deal with employment struggles.

About 46 percent of recent MSU graduates indicated employment following graduation in 2010, down 9 percent from two years prior.

Those trends still haven’t deterred employers from venturing to MSU.

About 225 company participants flocked to MSU for last year’s Career Gallery, and more than 5,000 students attended the job fair.

Consumers Energy, an electrical company based out of Jackson, Mich., has a strong connection with MSU and consistently provides employment opportunities to students and graduates, said Suzanne R. Jones, a senior human resources consultant with the company.

Jones said MSU graduates definitely are suited to step into the demands of the workplace, which can lead to a payoff for both parties.

“We say we hire the best and the brightest — it’s a very competitive process,” she said. “They’ve been very well-prepared.”

Jones said time spent in the company’s internship program oftentimes can lead to future employment with the company.

“Our MSU interns do a fantastic job,” she said. “MSU probably provides us some of the greatest numbers.”

Other employers across the country agree with Jones, including General Mills, Inc., which traditionally sends representatives in search of potential employees to MSU.

“The students that we hire are prepared for the demands of the work environment,” said Heidi Hampton, a recruiting manager with the company. “We do hire a number of MSU graduates each year. … We find that students meet those expectations at MSU.”

Stepping into the job market with a degree and enough experience to land a job remains difficult, said Kelley Bishop, executive director of MSU’s Career Services Network.

“Those that work on this the most probably have the most options,” he said. “It’s proven time and time again. … It’s pretty difficult to jump into. You’ve got to build up to that.”

Discussion

Share and discuss “Degree value worth another look?” on social media.