Let’s state the obvious.

MSU might not be the cheapest place to get an education — at least that’s how media arts and technology senior Briana Booker feels.

Let’s state the obvious.

MSU might not be the cheapest place to get an education — at least that’s how media arts and technology senior Briana Booker feels.

In hindsight, when Booker knows she’ll be more than $40,000 in debt after graduation next December, she’s not convinced the schooling will have been worth the high cost.

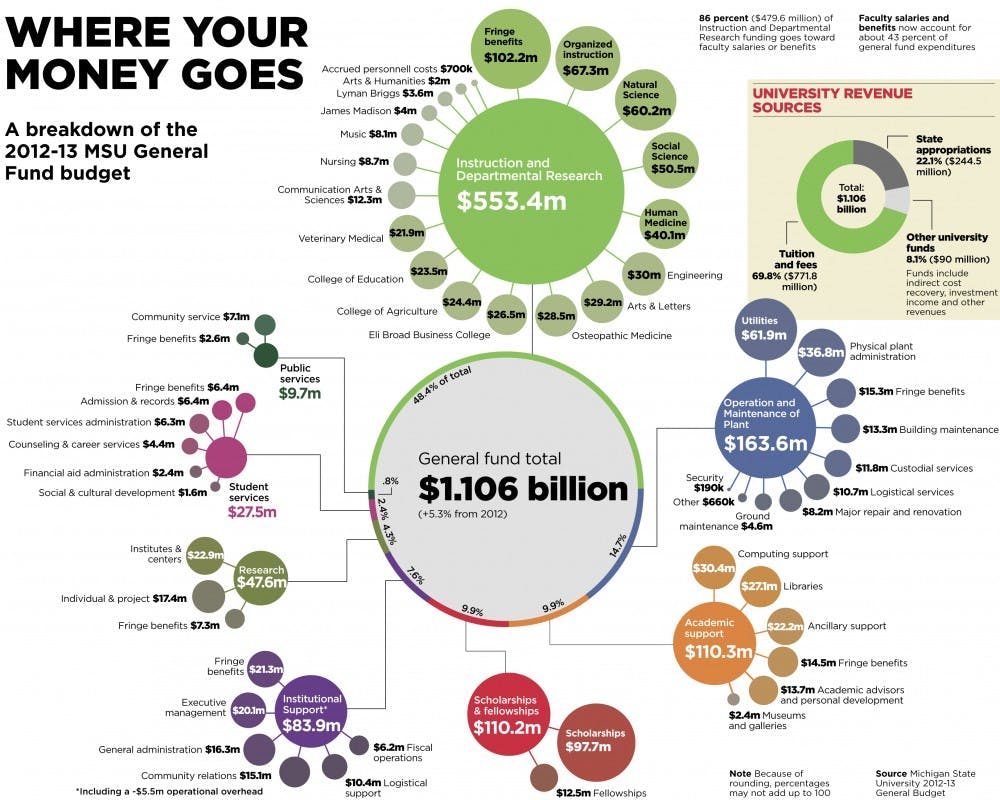

As tuition costs steadily have increased throughout the past 10 years, totaling 69.8 percent of MSU’s general fund budget in the 2012-13 fiscal year, some students are left wondering exactly where their tuition dollars are going.

Booker is not the only MSU student asking — is it worth it?

“(MSU’s) a good school, but money-wise, it is really expensive, and I’m putting myself through school,” she said.

A balancing act

Steadily rising tuition costs are not a trend limited to MSU.

As overall state aid to Michigan higher education institutions throughout the past 10 years has decreased, many public universities, such as MSU, have increased tuition as a way to balance costs, while continuing to fully function, Director of the Office of Planning and Budgets David Byelich said.

Booker, like many other MSU community members, feels as if these budget cuts shouldn’t be on the shoulders of students.

“People want careers — you don’t want just jobs,” she said. “You need education to get into a career, so why would (the state) not make it affordable for people who need it?”

According to the Office of Planning and Budgets, throughout the past 10 years, state appropriations to higher education institutions have decreased overall, totaling a reduction of $81 million by the 2012-13 fiscal year. And accompanying the steady rate of inflation, MSU has been accumulating a deficit of $166.6 million since 2002.

This past June, the Board of Trustees once again voted to raise tuition by 3.5 percent in the 2012-13 academic year — a decision Trustee Joel Ferguson fears they will have to make again this June if the state funding trend continues.

MSU’s projected 2013-14 budget, which was released in June 2012, is slated to have a 4 percent increase in tuition and fees, according to the Office of Planning and Budgets. Byelich said the increase is not finalized.

Ferguson said MSU is down to the bone in terms of spending.

“The legislature is going to give us fewer dollars and then (they’re) going to holler when we raise tuition — that’s just the pattern,” he said.

State Rep. Al Pscholka, R-Stevensville, chairman of the House Appropriations Subcommittee on Higher Education, said the funding decreases are a result of the nation’s economic problems and borrowing and saving habits.

“We (as a nation) don’t save the way that we used to,” he said “We should invest in higher education, but if all we are doing is paying off our debt, we won’t be able to make those investments.”

To compensate, Byelich said MSU has been saving on health care costs, wage increases and increasing student enrollment, among other reductions — along with tuition increases.

“It’s not a matter of offsetting the reduction, but (what) we really need to (compensate) is that inflation line,” Byelich said. “A lot of things cost more in year two than they did in year one. That’s because the cost of oil goes up, the cost of health care goes up and so forth.”

Support student media! Please consider donating to The State News and help fund the future of journalism.

Crunching the numbers

Byelich said the university is constantly on its toes to balance the quality of and access to higher education — he calls it, the “value proposition.”

While MSU’s total budget rounds to about $2 billion each fiscal year, the fund where tuition revenues fall, or the general fund, only accounts for about half of the budget.

In the fiscal year 2012-13, the general fund totaled about $1.1 billion. This fund covers eight areas of university functions, including course instruction, research and community services, among others.

But the general fund does not account for intercollegiate athletics, research grants, endowments and gifts — such as the gift donated for the construction of the Eli and Edythe Broad Art Museum.

Those expenses come from other auxiliary, expendable and designated funds — totalling the $2 billion when added with the general fund, Byelich said.

Although ASMSU President Evan Martinak is aware of these technicalities, he said he’s not sure if the entire student body understands that tuition revenue only covers academic expenses and basic university functions. ASMSU is MSU’s undergraduate student government, and the budget is presented to its leaders each year.

Still, in terms of knowing where money is going, some students, such as physiology senior Paul Westrick, are in the dark. Although he has faith in the university’s ability to manage the budget efficiently, he worries about the debt he’s accumulated while paying for his education.

“(Tuition is) pretty steep, but it’s understandable for the things that we get for the money we give,” Westrick said.

Forecasting the future

Each year, the state government will determine how much appropriations it will divvy out to public institutions. It then is up to the Board of Trustees to make all final major budget decisions for MSU, which will be in June.

Gov. Rick Snyder has made a recommendation to increase appropriations by 1 percent for MSU in the upcoming fiscal year.

Pscholka said he expects the House’s recommendation to be higher than 1 percent. The recommendation will not be released until early next week.

The state also puts a cap on how high public universities can raise their tuition, which Snyder has recommended be at less than 4 percent, Pscholka said. When the governor, House and Senate reach an agreement on appropriations, they will notify MSU. This should be in late May, he said.

When it comes to any type of increase, Martinak said it can be detrimental to students, such as Booker, who are unsure of how to dig themselves out of debt.

Eventually, the increasing cost of college is going to reach a breaking point, he said.

“I think that somebody soon in government is going to realize it’s not sustainable,” he said. “Young 18-to-24 college-age (kids, landing) … Thousands of dollars in debt just to attain higher education is not a sustainable system.”